by Elisabeth Schaffalitzky PhD

We asked our customers to fill out a survey in April, asking about their experiences so far with the COVID 19 shutdown, the effect on their businesses, and their expectations for the future.

We did this again in June to see if there were any changes or interesting comparisons that occurred between the two time periods. Certainly a lot has happened in the last two months!

The Sample

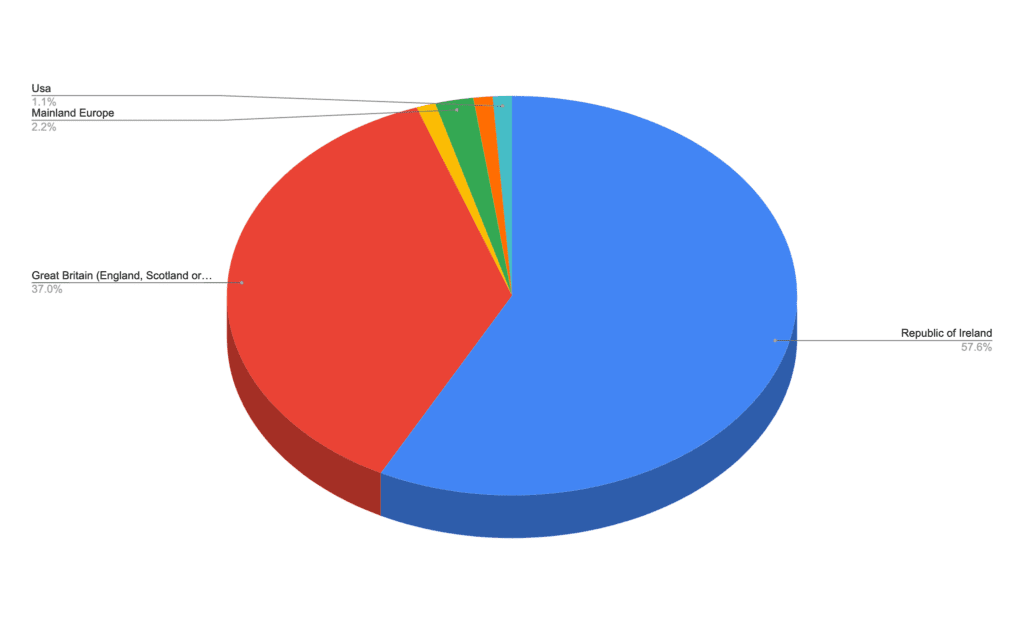

We received 92 responses from our customer base and those who follow us on social media. Of these, 57.6% are in the UK, 37% are in ROI, with a tiny percentage from outside these regions.

In terms of occupation, the biggest part of our sample are Instore Managers (25%), followed by Business Owners (22.8%), and Instore Supervisors (16.3%). Then Operations, HR, Baristas and Directors make up the biggest parts of the rest of the sample.

In terms of types of business, Coffee business made up the majority of responses (43.5%) followed then by Bar/Pub/Nightclub (17.4%) and then restaurants (14.1%).

Furlough Pay

As of the last week in June, 40.4% of the sample are receiving Furlough pay, 29.2% are on full wage, 14.6% had a pay cut, and 15.7% were laid off.

This was a slight reduction Furlough paid workers in comparison to our April results (40% vs 50%), and an increase in those on full wage (29.2% vs 16.6%).

While we are using anonymised data, so we do not make direct comparisons between the two data sets, these numbers likely indicate the trend of workers returning to paid employment in hospitality as businesses reopen, which is great to see.

Operations

As of the month of June, 46.7% or our sample had closed businesses. 34.8% were open, and a further 18% were operating with reduced services.

This is a reduction of over 25% in comparison to our April numbers for closure (75.5%), and then a big growth in numbers for those now open (from 9.1% in April). Again, it’s easy to conclude these changes are a reflection of the re-opening of many hospitality businesses in the last month.

For our current survey, Coffee business was split evenly between Open Vs Closed, but zero Bar/Pub/Nightclubs were fully open. Restaurant businesses and Coffee business made up most of the Reduced Operations replies, but restaurants were also starting to open again fully.

This was similar to our result in April which showed Restaurants and Coffee businesses able to adapt best to reduced operations, and Bars etc struggling most with the shutdown restrictions.

Reopening Plans and Guidance

56% of respondents believed they would open in July 2020, and 28.8% in June 2020, so that’s a large majority back in operations before August. This was an increase from 65% in April, so probably indicative of the speeding up of reopening plans in the UK and Ireland over the past few weeks.

Coffee businesses were the most likely to think they would reopen in June, with Bars/Pubs/Nightclub respondents leaning towards July. There were still some businesses who were waiting till later months of 2020, or next year, or even a vaccine.

Interestingly, 25% of our sample thought guidelines were unclear on when they could reopen. These were mostly in the bar/pub/nightclub section. There was no difference by geographical location on whether guidelines were considered clear or not.

This possibly relates to the speeding up of reopening plans that were outlined by the Irish Government, and the changing conditions at which businesses must operate social distancing. The UK government is also unclear on the status of all these businesses which may not be able to implement social distancing.

With regards to guidelines on operations after opening, 37% of respondents felt that they were also unclear, with many again being in the bar/pub/nightclub group, though there were concerns with most areas of business. One comment described themselves as in ‘total limbo’ and another worried about how to deal with customers who refuse to adhere to guidelines.

Others were looking for specifics on reusable cutlery; how customers can use toilets; how many staff should be allowed work at the one time; how to work with scheduling smaller teams. Furthermore, just how ‘mandatory’ any of the rules really are was a concern: how could or would rules be enforced?

Changing Businesses

When looking at how they could operate their businesses currently, 67% of our sample had investigated other options than ‘Business as usual’. This was an increase from just 55% in our April survey. Of those who said this was impossible for their business, predictably bar/pub/nightclub group featured highly, with a small number of coffee businesses, and a specific catering business also unable to adapt.

Of the options suggested Take away(60%), Delivery (46%), Online Orders (38%) and Radically reduced numbers on the premises (47%) were the most popular choices, with Coffee businesses the most likely to adopt these measures, followed then by restaurants. Service expansions and ‘Other Online Option’ were less popular, but still each selected by 20% of respondents.

In comparison to April’s data, this was a 20% increase on the Take Away option, and a 20% increase in the Delivery option. There was also almost a 30% increase for reduced numbers on the premises. Indeed for all options there was an increase in those investigating them in comparison to April.

While we cannot draw direct comparisons to our previous data, this increase likely indicates an increased need to look for answers, and also a willingness of the general public to look for take away and delivery options from businesses you wouldn’t have previously expected to offer these options. Anecdotally we all know of restaurants and bars doing meals kits, take-away cocktails, and similar offerings.

Concerns and Safety Measures

The highest concerns on returning to business operations were related to costs and ability to make money: would there be enough customers (44%); the ability to pay staff and suppliers (46%) and the extra costs associated with safety procedures (42%). The other biggest concerns related to motivating staff to return to work (35%) and the health and safety concerns for themselves (36%) and their family (32%).

These numbers were slightly lower than those expressing similar concerns in April, and possibly indicate how the easing of social distancing restrictions has reduced concerns, as well as just a general decline in anxiety around the virus. Potentially, we now see the virus as less of a threat than we did in April.

For safety measures in store, 82% of respondents were implemented safety and hygiene training, and 80% hygiene and sanitary stations for staff. Similarly high numbers will have staff wearing protective equipment (78%) and warning signs for customers (71%).

Nearly two thirds (65%) of the sample had distancing implemented in queues, and 60% had reduced their numbers in store. 46% were spreading out tables and chairs for distancing.

Half of respondents had perspex protection for staff (49%).

In terms of customer behaviour, only a third of businesses were only taking card payments (33%) and only 10% were getting customers to wear masks or other protective equipment.

In comparison to April, this is actually a slight drop in terms of those who expected to implement distancing measures (76% reduced numbers in store, 70% distancing in queues), and also card payments (55%). Again, what we could be seeing here is a decrease in anxiety around the virus spread, as well as better knowledge about the role of hygiene in preventing transmission through touch. Similarly, the reality of only accepting card payments may impact negatively on some customers, so might not be worth enforcing.

But in comparison to April, staff training is about the same, and there’s a large uptick for sanitary stations for staff (which wasn’t given as an option in our last survey, but is clearly very important). This potentially puts a lot of the onus on staff and the business to maintain hygiene, rather than relying on customers to also adhere to guidance.

How things are now

In terms of communicating with their customers, social media is still extremely popular with 74% still communicating this way. And in comparison to our last survey, 46% of our respondents are now communicating in store as they’re operating. There was also an increase in those using mailings lists (13% Vs 5% in April), online advertising( 22% vs 5% in April) and local advertising (7% vs 1% in April) to spread the word about their business.

This likely shows who businesses are now operating in some capacity if they are going to advertise: there is the willingness to spend their budget to increase revenue.

For those who have reopened, we asked what had been difficult about opening, and the biggest issue was reduced customer numbers as people are not coming to their business (41%), in comparison to reduced customer numbers due to social distancing measures affecting covers (33%). Supply chain interruptions were next highest at 28%, with organising safety measures at 22%. Despite the concerns around motivation, only 17% had difficulty with getting staff back to work. And similarly only 14% had difficulty with navigating the advice on reopening, even though more had issues with the guidance they’d received.

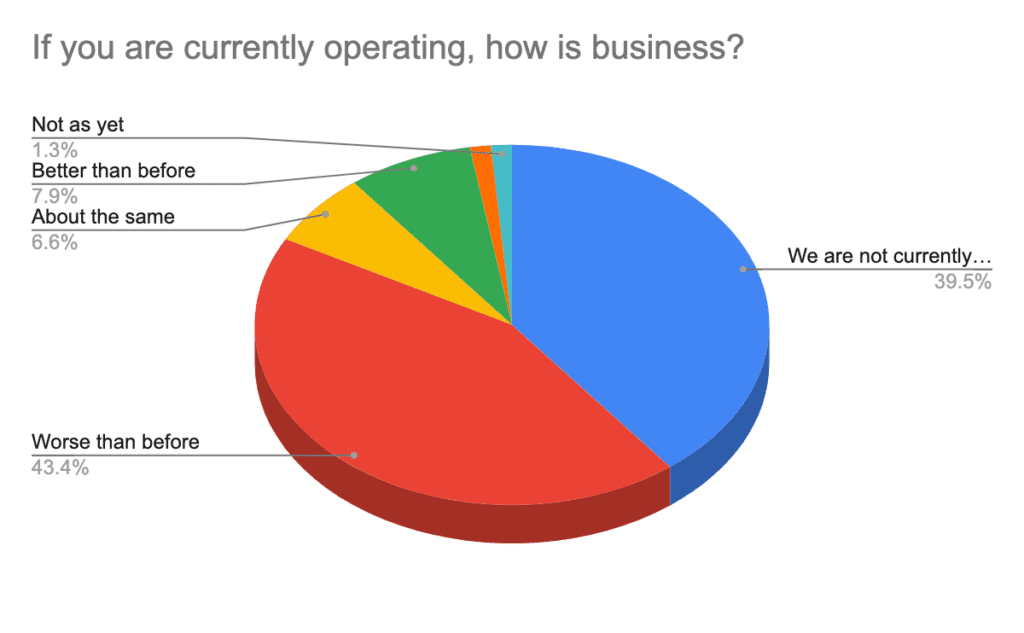

Of the approximately 60% of our sample who said they were currently operating, 44% said they were worse off than before. A small percentage (5%) said they were about the same, and 7.9% were better than before. There was no particular business that was doing better or worse than another, this sentiment was similar across all the businesses. Similarly, there was no difference in geographical location.

This is of course a worrying trend, but likely indicative of the nature of business currently: less people are working in offices, and visiting town centres, which is reducing footfall in certain locations. And of course there are many people who are experiencing unemployment or wage reductions, which will decrease spending in the economy. Despite government supports, the public may be wishing to save money at the moment as recession threatens.

Conclusions

While this survey was a small sample of the current operations of hospitality, it does give us a nice snapshot of where a lot of hospitality businesses are at this moment in time.

Sentiments around the ability to reopen are generally improving. Furthermore, the increase in looking for alternatives to current operations is interesting, as it shows how hospitality as we know it is changing.

There are indications that there is a general easing of anxiety around safety measures needed in businesses, as people’s concerns move more towards business interests like the costs of reopening, and away from personal well-being.

These feelings will rub up against the ability to keep a business operating, whether that’s due to increased costs, decreased customer numbers, or the general stress associated with the changing landscape of what we know to be safe or unsafe.

While government supports can help with businesses accumulating rent costs or bills, there is only a certain period of time many of them can remain closed for safety reasons alone.

As we start moving to a phase of reopening for most hospitality businesses – August sees the reopening of most pubs and nightclubs in Ireland, and September a returning of childcare and schools – the ability of the hospitality and retail industry to retain customers, retain staff, and keep operating will hopefully improve, but there are still uncertainties around how this might look, and how permanent safety procedures and social distancing may need to be.

How the general public and businesses perform in reducing the spread of Covid-19 in these months, and through the Winter, will likely affect how hospitality and retail businesses operate into the future.

Want to see more of our findings? Get in touch by phone, email, or on social media!

We got you covered.

Sign up to the Bizimply newsletter for the latest industry findings every week.

Phone:

(UK) +44 203 642 5644

(IRE) +353 (1) 254 2524

Email: [email protected]

Help Centre: Click Here

Twitter DM: @Bizimply

LinkedIn: Bizimply