Download our Free Tronc Calculator Today

What is Tronc?

Derived from the French for ‘collecting box’, a tronc scheme is a type of pay arrangement often used to share tips, gratuities and service charges among employees.

Our Calculator: How It Works

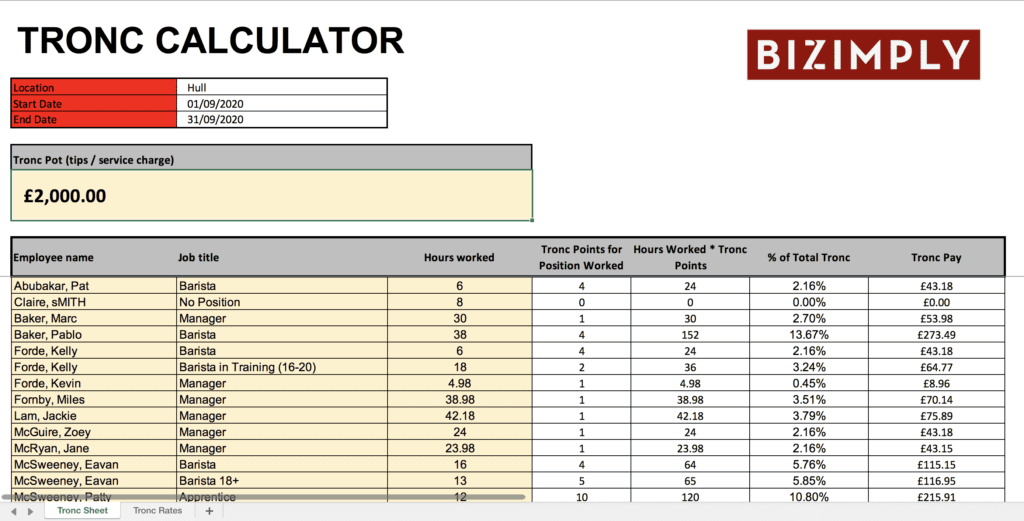

The Bizimply Tronc calculator can assist your Troncmaster to allocate the pot easily and transparently.

Using the Bizimply calculator we can even pay different rates per employee depending on the positions over the timeframe. Pull the information direct from Bizimply for the required timeframe Simply enter the pot balance and Bizimply will take care of the rest.

Setting up your Tronc Calculator

How to use Bizimply's Tronc Calculator

How to set up our easy-to-use calculator to get the information you need, fast.

- Enter the Tronc Rate per position.

- Enter the Total Tronc Pot for the period.

- Enter your employees, the position the worked and the total hours they worked in each position.

- Enter the total hours they worked in each position.

- Each employees % of the total tronc pot is automatically calculated.